Key Points

- If you're still working, the best way to get the maximum Social Security benefit is to--surprise--keep working, and make as much money as possible.

- If you're no longer working, or if your working years are mostly behind you, there are other strategies you can employ to maximize your benefits.

- Decisions you make about Social Security benefits normally can't be reversed, and it isn't always clear what the best decisions might be, so it's best to test out those decisions using retirement planning software like WealthTrace before implementing them.

Are you in position to get all of the Social Security benefits you're due?

Working a lot of years and making a lot of money is the best way to do this. The longer you're in the work force, the better chance you have of getting a higher benefit. This is because Social Security benefits are based on average monthly earnings over the 35 years you made the most money in your career.

But if you're retired or close to it, you can't go back in time and earn a bunch more money each year. Nor can any of us say how long we'll live, so it's often not clear when to start taking your benefits. Is 62 the best age? 70? Social Security's Full Retirement Age (FRA) figure? Certain things are out of our control.

But certain things definitely are in our control when it comes to Social Security, and making sure we get as much as we can out of it. We'll run through those things now.

Just You Wait

If you're in a position to do so, waiting to take your benefits--certainly beyond age 62, and at least as long as FRA--makes the most sense.

The conventional wisdom that delaying benefits each year past retirement age equals an 8% annual return isn't exactly true. There are opportunity costs to consider, not to mention inflation, and the possibility that, well, you might die before taking any of your benefits. But waiting will add inflation-adjusted returns in the 4% to 5% range each year, and virtually risk free. That's nothing to sneeze at.

Waiting until 70 years old before taking your benefits is the ideal in terms of maximizing their value. Very few people wait this long--somewhere in the range of 2% to 4% of Social Security recipients--but more certainly should.

We have written before about the urge some well-intentioned retirees have to start taking their Social Security benefits before drawing down much on their investment assets. In short, this is not usually the way to go. It can be tough to break the (good) habit of saving and investing after decades of doing so. But if you have to choose between one or the other, it's usually best to start using your investment portfolio to cover expenses, and to wait to take your benefits.

This is mainly for the aforementioned additional risk-free benefits that accumulate each year, but there can be other reasons to do so as well. For example, if you have a Roth IRA, you've already paid taxes on it, so drawing down on a Roth can make a lot of sense. It's almost always advisable to defer taxation, and Social Security benefits are taxable.

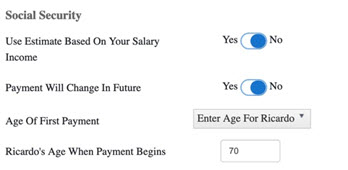

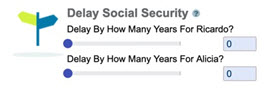

A program like WealthTrace can help you make the best decision about when to take your benefits. You can sign up for a free trial today and run your own Social Security scenarios. In WealthTrace, once you have your plan set up with all of your investment accounts, sources of income, and an estimate of your spending needs, you can start trying out various ages at which to take your benefits.

There will be exceptions to the rules, of course. While none of us knows when our time will be up, it's important to be honest with yourself about your health. Take your family health history into account, as well as what you know about your own health issues, and use that information to at least help inform the decision. It's worth keeping in mind, though, that it's the rare person whose dying wish is, "I wish I had started taking my Social Security benefits earlier."

Marriage Strategizing

If you're married, and both of you will be receiving Social Security benefits, there are a few things you can do to make sure those benefits are maximized.

If you haven't started taking your benefits yet, the first thing to do is to check at ssa.gov to see what said benefits are estimated to look like. Who is/was the higher earner?

Once you have that figured out (and the Social Security Administration's web site will make that clear), you can start strategizing. For example, if you're planning to start taking benefits, it could make sense to start with the lower earner's benefits first.

Why would you do this? Mostly it has to do with what we mentioned above: If the higher earner waits, their benefits will be worth more over time, simply because their benefits will grow more, starting from a higher base amount.

If one person's estimates of benefits are more than double the other's, the spouse with the lower benefits should probably claim first--and then apply for spousal benefits once the higher earner starts to collect.

It gets even more fun from there--if one spouse turned 62 before the end of 2015, when congress eliminated the so-called restricted application provision. In cases where this still applies, it goes like this. The younger person claims their benefits, based on their own earnings history (that is, not using the spousal benefit). Then, when the older person gets to the Social Security Administration's full retirement age (FRA) designation, they file a restricted application, meaning they also claim benefits based on the younger spouse's earnings.

Finally, at age 70, the older spouse can move from the younger spouse's benefits to benefits based on their own earnings history. Those benefits will have increased more than 30% compared to if they had taken them at FRA.

Knowledge Is Power, and So Is Software

Did you get all of that? It can be tough to follow, especially at first. Be sure to do your due diligence, reading up on your options when it comes to Social Security benefits. Once you have a grip on those options, it's time to plug it all into a software program like WealthTrace, which can handle the details.

Do you want when you should start taking Social Security benefits? Sign up for a free trial of WealthTrace to build your own comprehensive retirement plan and run scenarios to find out how you can maximize your benefits.