Key Points

- The order in which you intend to tap into investment accounts at retirement is a significant decision.

- There are general guidelines for drawing down on your assets in retirement, but everyone's case is different.

- Simulating the 'locking out' of certain accounts is helpful for a number of reasons, including determining what accounts you might like to pass on to heirs.

As you're heading toward retirement, if you're doing it right, you probably have a number of different accounts you're planning to draw on. You might have a brokerage account or two, an IRA, a 401(k) that will eventually be rolled into that IRA, and so on.

And you have choices to make about how you want to spend down that money. Once you stop working, which accounts do you want to use up first? Or does it make sense to spread it around, taking from multiple accounts at a time?

There is some conventional wisdom to draw on here. Generally, you'll want to take from taxable accounts first, and maybe Roth IRAs too. You paid taxes on your Roth contributions on the way in, so none are due when you start taking money out of them. You'll probably want to hold off on taking from traditional IRAs (aside from required minimum distributions) for as long as you can because taxes will be due on those withdrawals. The name of the game is deferring taxes for as long as possible.

But there's always a but--an exception to the rule. You might have reasons you don't want to follow protocol here. Maybe you have massive unrealized capital gains (and congratulations if that's the case) in a taxable account that you would rather not realize. You might have a 529 plan that you have been funding for a grandchild's education, or you might be using mental accounting to assign a certain investment account to a specific anticipated goal or expense.

We would not be able to cover all the possible reasons a retiree would want to go against conventional wisdom in a single article. But we'll try to demonstrate the importance--and the power--of carefully considering and then specifying from where you plan to fund your retirement spending.

First This Then That

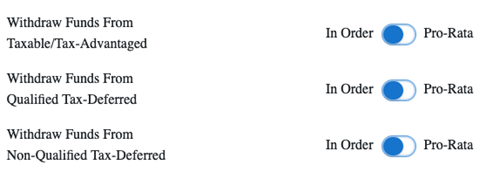

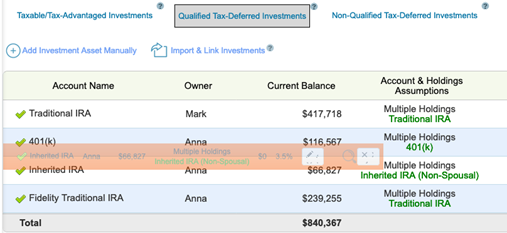

WealthTrace is almost infinitely customizable for ordering your account draw-downs. Out of the box, the program will first draw from taxable and tax-advantaged investments, then go to non-qualified tax-deferred investments (if there are any), and finally to qualified tax-deferred accounts like traditional IRAs. Within those categories, by default, the program will draw down in the order the accounts are listed. If you would rather assume proportional withdrawals based on the assumed balances at the time, you can do that instead.

You can specify how you would like to draw down on your accounts in WealthTrace.

You're also able to drag and drop rows within each investment section.

One reason to try locking out accounts is to see what you can get away with.

That is, if you're thinking about passing along assets to heirs or a charity someday, you might want to tell the program, "Assume this particular investment account grows over time along with the broader markets it's invested in, but also assume it's not available for my use in retirement." You're earmarking that account for inheritors here. If you do that, and your Monte Carlo results are still in a range you're comfortable with, locking the account out might make sense for you.

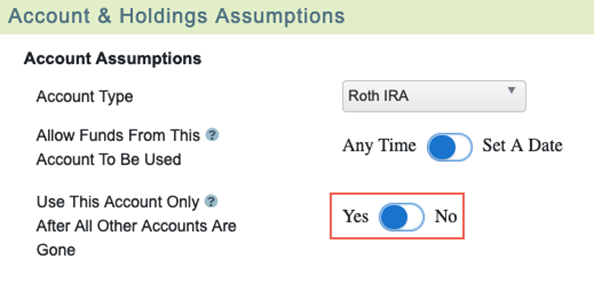

Here's how you would do so in WealthTrace.

We'll use a Roth IRA as an example. A Roth is often a go-to account for retirees to draw on because, as mentioned above, no taxes will be due on those withdrawals. But maybe you're not too concerned about taxes yourself, and instead would rather heirs not have to deal with them.

In this plan, a couple in their 50s with about $1.5 million in assets and a few passive sources of income has already retired. They have their investments allocated in a way they are comfortable with and that they feel is appropriate for their risk tolerance and goals.

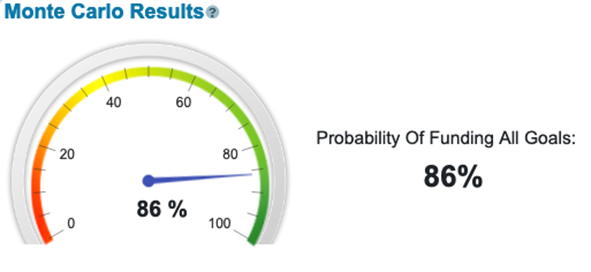

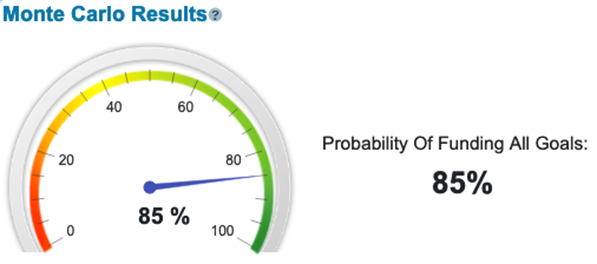

With no lockouts in place, they have a comfortable 86% chance of funding all of their retirement goals.

So they decide to see if they can live without their Roth IRA, currently worth around $80,000 and mostly invested in value stocks.

With WealthTrace, you're able to tell the program to save an account for last or assign a date in the future for when the account can be used. If you do so, a lock will appear on the account.

It turns out that locking out the Roth leads to a very minor drop in the Monte Carlo Results. The couple is able to hold onto it for heirs with not much trouble.

Give It A Test Run

As we mentioned above, there are plenty of reasons you might want to do something like this--or even multiple variations of it at a time. By multiple variations, we mean you could do this with multiple accounts at a time. You might say, "Assume I can't touch my taxable accounts until I'm 70, and that my Roth IRA is locked away past my life expectancy. What do these assumptions do to my plan?" You might do this to defer realizing gains on the taxable accounts and to pass the Roth on as we just discussed. The important thing is to think through what permutations might be applicable to your situation, and then simulating them in a program like WealthTrace before making any irreversible decisions.