Key Points

- The cost of college tuition is finally declining relative to overall inflation.

- Although it doesn’t always show up in the published tuition rates, scholarships and grants are reducing the fees for many new college entrants.

- This is a big change from the huge increases we’ve seen in the past twenty years.

From 2003 through 2013, college tuition nearly doubled. It had been increasing for years before that, but the increase truly accelerated during this time frame.

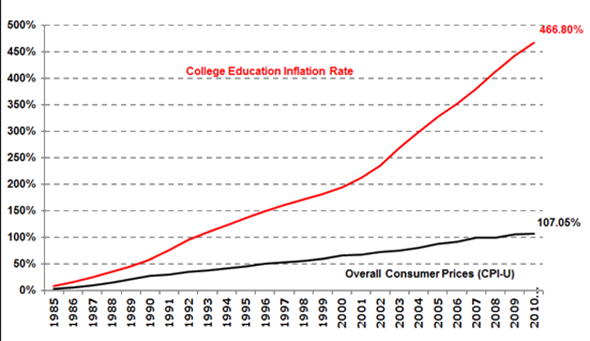

Adjusted for inflation, the cost of going to college went up by about 350% from 1985 through 2010. The constant increasing costs of going to college became a major burden for both students and their parents. Many parents sacrificed an early retirement to help put their children through school and many students left college saddled with thousands of dollars in student loan debt.

College Costs Are Finally Coming Down

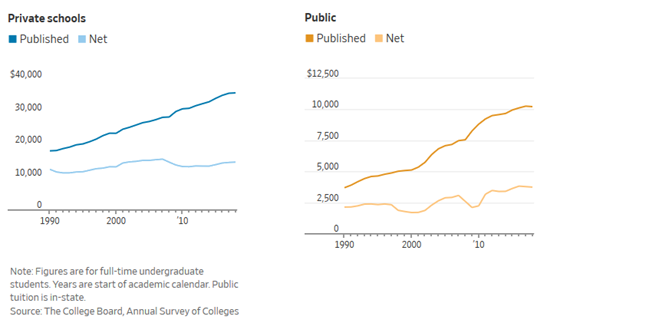

Not only has the cost of going to college stopped its rapid increase, it has actually fallen slightly over the past two years. It’s not easy to discern this if one just looks at tuition rates. But if we look at the net cost of a college education, which takes into account scholarships and grant money, we see a different picture.

How College Costs Can Impact Retirement

We all know that starting out post-college life saddled with a large amount of debt can cripple one’s ability to save for the future. It’s a serious problem for an entire generation of young adults today and is even preventing many of them from buying a home.

What is probably less understood is how many parents have had their retirement plans upended by paying for their children’s college education. The huge increase in the cost of going to college over the past twenty years caught many people off guard and it severely impact a lot of retirement plans. Many people had to work longer or downsize their home just to help put their kids through college.

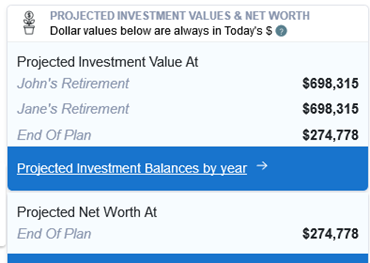

I used the WealthTrace wealth management software to look at various scenarios where the cost of college increase, stay flat, and actually decrease relative to overall inflation. I looked at a couple with $300,000 in taxable investments and $300,000 in IRAs. They plan on using their taxable money to pay for college for their two children, who are currently 12 and 10 years old. Their current plan is to pay for tuition for both for five years. Tuition is currently $15,000 per year for each child and they plan on taking five years to graduate.

If college costs are projected to move at the same rate as inflation (I assumed 2.5% annually), this couple is projected to have about $700,000 saved when they retire and nearly $275,000 when they reach their life expectancy.

But what happens if the increase is college tuition reverts back to its old ways of outpacing inflation? I took a look at a few scenarios in this retirement plan where tuition rises at 4%, 5%, and 6% per year over the next 15 years. Here is what I found:

College Costs

Inflation Rate | Investment Value ($)

At Retirement | Investment Value ($)

At End Of Plan |

| Base Case (2.5%) | 698,315 | 274,778 |

| 3% | 665,200 | 254,800 |

| 4% | 602,100 | 230,500 |

| 5% | 536,500 | 190,500 |

An increase in the inflation rate for college expenses from 2.5% to 5% knocks quite a bit off this couple’s savings when they retire. It also means they would have nearly $300,000 less at the end of their plan. And this is for tuition at $15,000 per year. If the kids were going to a private school, tuition would be at least triple this amount.

But the change in fortunes also works the other way. If the growth rate in college costs goes down, which it currently is doing, this couple will see their retirement situation improved. I found that if college costs don’t budge for the next ten years they will have nearly $80,000 more saved for retirement and over $250,000 more at the end of their plan.

Retirement Projections Can Be Volatile

Scenarios like we have run today show just how volatile retirement projections can be when growth rates change. Whether it’s inflation, annual return assumptions, or college tuition inflation, the changes in assumed growth rates are exponential over time and thus the impact over longer periods of time becomes larger and larger. This is why it’s so important to run lots of what-if scenarios on your retirement plan to see what might happen if your costs aren’t what you planned them to be. This way more informed decisions can be made.

Find out how much you need to save in order to retire comfortably. Sign up for a free trial of WealthTrace today. Learn more about how WealthTrace can help you.