Key Points

- Because the cost of living varies so much across the country, retirement savings will go a lot farther in some places than in others.

- The effect of taxes on the success of a plan can be substantial.

- Looking at costs is important, but there are plenty of other factors that will determine where you want to live in retirement.

A recent article in Money magazine caught our attention. "Here's how long a $1 million retirement nest egg will last in each state," says the caption.

The gist: The cost of living varies regionally. A million dollars in one place can be quite a different amount than a million dollars in another. So if you think you've hit your number and are ready to retire, make sure you know what your cost of living will be where you're planning to live. That general concept is no surprise--and the cheapest and most expensive states might not be either.

There's no one-size-fits-all model to a successful retirement plan. Everyone's needs and wish lists will vary, and there are far more determinants than cost of living that will determine where you want to live. Not to mention that the research for this article assumed 0% investment returns after retirement, and no changes in the cost of living over time--not exactly real-world stuff. Finally, a million dollars in one part of a state (out in the sticks) could last a lot longer than a million dollars in another part of the same state (the big city). So doing this kind of research by state is perhaps not the most useful way to go.

Still, it's definitely worthwhile--and even kind of fun--to consider what a move could mean for the potential success of a retirement plan. After all, this comes up in real life all the time. A retired person or a couple might decide the house is too large or takes too much work to maintain, and that a condominium would suffice. Or maybe winters or summers have become just a little too tough to take.

Housing and healthcare costs are the most important factors mentioned in this article. Taxes can be another big one. Part of Florida's "business model" is arguably to attract high-net-worth individuals who are ready for more beach time and like the look of a 0% state income tax rate, when they're used to a 7% or 10% top marginal rate. (Though, as a recent Bloomberg article mentions, if you're one of these fortunate people and you're planning to move, you'd better actually do it, or the state you're moving from might try to call you its own for tax purposes.)

When thinking through the tax issue, consider the following. If, in retirement, you expect to be generating a lot of taxable income, the state income tax rate is going to matter a lot to you, just as at the federal level. Marginal income tax rates in California, for example, are effectively 13%; most people will feel the effects of that, even if they're well off. On the other hand, if you're going to be spending a large portion of the income you're generating during retirement, the state sales tax might be more important to you. Just as $1 million in one place is not $1 million somewhere else, high taxes are not high taxes. It's all very personalized. (Property taxes can also be a big portion of one's overall tax burden, and those should be taken into account in retirement the same way they are before retirement.)

None of that should be earth-shattering news, but it's helpful to step back and really consider what it is we're talking about.

Tax Scenarios

You don’t need a financial advisor to run through what-if tax scenarios. You can actually run these scenarios yourself using the WealthTrace Retirement & Financial Planner. We use the WealthTrace Planner to work through a case--an admittedly extreme one--of what a lower tax rate could mean for a plan.

In this case we have a well-to-do 59-year-old couple looking to retire within a year. They have about $7 million in invested assets, and plan to spend like it once retired: They estimate their expenses will be $230,000 per year.

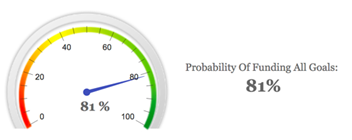

They live in a state with a relatively high tax rate of 7%. Even so, they've got an 81% chance of funding all of their retirement goals, according to our Monte Carlo simulation.

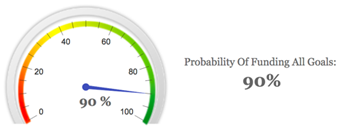

If they find somewhere they like with a 0% state income tax rate, the results improve substantially:

This makes sense. It is, after all, a reduction in spending. Spending less money on any expense should have a positive effect on a plan.

The lower taxes might have an added benefit. The cost of living is, generally speaking, often lower in places with low state taxes. There's a decent chance that other, actual day-to-day expenses will be lower than they're used to as well.

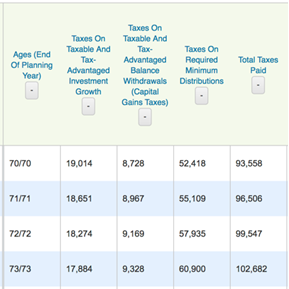

WealthTrace can tell you, year by year, what your estimated taxes will look like.

To Each Their Own--And Maybe Some Extra

In the end, as we've said, there's a whole lot more to this decision than just the cost of living. For example, forget the cost of health care mentioned in the article. Is it even available in reasonable quantity and quality, especially in some of the lower-cost places one can retire?

That's probably toward the top of the list of a lot of people's questions, but there will be many more too, having to do with proximity to family and friends, amenities you can't live without, weather, and community. Don't forget to consider taxes too.

Have you thought about your retirement goals? What kind of return to expect from your investments? The effect of taxes and inflation on your savings? Sign up for a free trial of WealthTrace to find out if your retirement plans are on track.