Key Points

- Inflation is now at the highest rate it has been in over 40 years.

- To the surprise of many, stocks are usually a good hedge against higher inflation.

- Fixed rate bonds are one of the worst investments to own as inflation begins to ramp up.

Everybody is now noticing just how bad inflation has become. The Consumer Price Index (CPI) is running at 8.5% year-over-year as of April 2022. This is the highest rate of inflation in over 40 years.

When inflation is very high, like it is today, many people wonder what they can do with their savings in order to protect it from rising prices. Many savings and checking accounts still pay almost nothing in terms of yield. That means the purchasing power of the money in those accounts is being whittled away by inflation.

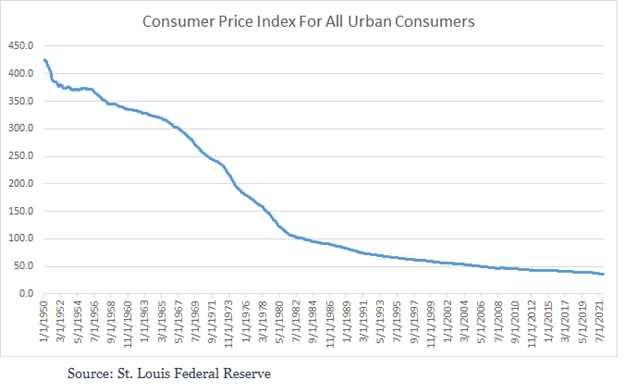

You can see just how much inflation can erode the purchasing power of your money in the chart below, which shows how $425 becomes less than $50 in real purchasing power terms over a 70 year period.

Stocks as a Hedge against Inflation

It may come as a surprise to some that stocks are actually a pretty good hedge against higher inflation. Many companies can raise their prices at the same rate of inflation. This means revenues increase and so do overall profits. As long as their earnings move with inflation, in theory their stock price should not decline.

This is good news for retirement portfolios since this is where most people have the majority of their savings and also have a large allocation to stocks. You can see just how periods of high inflation might impact your retirement portfolio and retirement plan by using the WealthTrace Retirement Planner.

It is important to point out that not all companies have the ability to quickly increase prices. Consumer staple stocks tend to be able to increase prices more quickly since people need to keep buying staple items such as toothpaste, napkins, etc.

On the other hand, companies that sell luxury items tend to do poorly in high inflationary environments, especially when economic growth overall slows. They just don’t have the ability to increase prices quickly like consumer staple companies do.

Higher inflationary periods are also bad for companies with a lot of debt because of the higher interest rates that usually occur with higher inflation. With interest rates increasing, companies with floating rate debt will immediately see their interest costs increase. If companies need to refinance debt, they will be doing so at higher interest rates, which eats into their earnings.

How Inflation Impacts Investment Portfolios

Inflation can be a massive blow to portfolios that hold a lot of bonds. This is because most bonds have a fixed rate of interest. If an investor owns a lot of bonds with a fixed yield of 3% and these bonds don’t mature for 10 years, if inflation is above 3% for 10 years they will have a negative rate of return over this time period.

Even worse, they will still be paying taxes on their paltry 3% income, even though it’s less than the rate of inflation.

If one is set on having a lot of bonds in his or her retirement portfolio it is best to invest in Treasury Inflation Protected Securities (TIPS) during periods of high inflation. These bonds are backed by the federal government and pay a yield plus the most recent annualized rate of inflation.

Another good hedge against inflation is Treasury I Bonds. These bonds are also backed by the federal government, move with the inflation rate, and unlike TIPS are not taxable at the state or local level. There is a limit to how much you can purchase though.

Cash, or money in savings and money market accounts, also loses out to inflation. If you put $1,000 into a savings account earning no interest and inflation is 8% for the year, this money will only be able to purchase $920 worth of goods and services after the year is over.

The Bottom Line

High periods of inflation can be stressful, both for companies and investors. But there are ways to hedge and it is a good idea to be diversified. We have seen throughout history that stocks, especially those companies that sell consumer staple items, have generally moved with inflation and are therefore a pretty good hedge against rising prices.

Do you want to run what-if scenarios on how inflation will impact your retirement portfolio? Sign up for a free trial of WealthTrace today and start running your own retirement planning scenarios.