Key Points

- Mutual fund and ETF fees can dramatically erode total returns over time.

- Fidelity has taken a big step in the direction the industry was already headed by introducing a series of zero-cost mutual funds.

- It could be a good time to open an account at Fidelity, but it could also simply be a good time to review what you're paying for what you own.

In August, Fidelity announced that it was launching a couple of index funds that would be free to invest in--that is, their expense ratios would be 0%. Between Fidelity Zero Total Market Index (FZROX) and Fidelity Zero International Index (FZILX) funds, you get globe-spanning passive equity investments with no fees attached. Fidelity has since added two more "Zero" funds--one for US large-cap companies, and another that invests in domestic small- and mid-cap companies--and it's a good bet that more will follow.

But while "Free" got all the headlines, it might have been the least important part of the overall news. First, there is no minimum investment on these funds, and Fidelity also announced that it no longer requires a minimum amount to open an account there (even a 529 college savings plan). Second, it cut the overall costs on a lot of its index funds and ETFs. Average asset-weighted expenses dropped by about 35% in the stock and bond index funds.

In short: Fees are way down, sometimes as low as 0%. Minimum investments? No longer an issue. If you had been dragging your feet because you couldn't make a $1,000 minimum or didn't know where to begin, your path has never been clearer: Get the change out from under the couch cushions, and tell Fidelity to put it into FZILX and FZROX.

Now, a question most likely relevant to more people reading this: Should those who have already been diligently investing and have had their accounts set up for years close all those accounts and move them over to Fidelity?

Probably not. The fact is that the industry has been headed this direction for a while. Low-cost index funds really seem to be

disrupting the actively managed side of the business in a meaningful way. It's long overdue, in our opinion.

Why Indexing Matters

Let's review. Why invest in index funds? Because you can't beat the market, for one. You might catch a break for a year or even a few years, but over time, the index almost always wins. You do have better odds picking an actively managed (non-index) fund that beats the market over time than winning Mega Millions, but not materially better odds.

Part of the reason for that: Fees. Actively managed funds' fees are high, or at least a lot higher than index funds' fees. Index funds do not cost much to run, since the fund company or asset manager doesn't have to do a bunch of research on stocks and bonds, or talk to company management, or fly (Business Class!) to, say, China to check on a potential investment's operations. All of that costs money (and so does a manager's salary and bonus). With indexing, the manager need only make sure the portfolio mimics the index performance as close as possible. If a holding gets added to or removed from an index, the manager buys it or sells it. There's more skill to this than it probably sounds, but it does not cost a lot of money.

So if you shouldn't pack it all up and ship it to Fidelity, what should you do?

What It Costs

Fidelity's announcement should at the very least be a prompt for you to have a closer look at what you own--and especially what you're paying for it. In other words, this is a good time to make sure your fees are not out of line. Think of it as what you do (or should do, anyway) with your cable or internet or cell phone bill from time to time, but with much higher stakes. Am I paying too much? Can I get the same or similar service for a lower price if I make some calls?

High fund fees over time can crush a retirement portfolio and can significantly change when a person can retire. You can see this for yourself using WealthTrace. You link your investment accounts, we look at your fund fees, and you can run some what-ifs on what a reduction in fees would mean to your account balances over time.

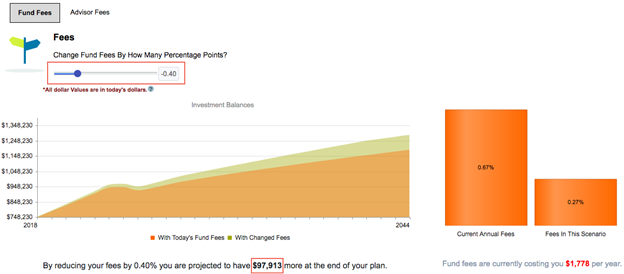

Here's an example of a couple with a fairly reasonable 0.67% expense ratio to start with. By reducing their fees to a Vanguardian 0.27%, we estimate they'll have nearly $100,000 more at the end of their plan.

WealthTrace can help you understand that a small fee reduction could go a long way.

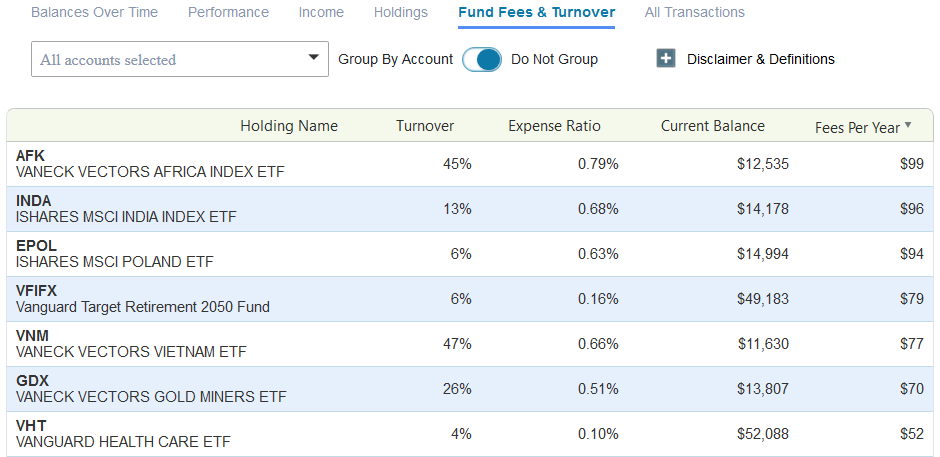

In WealthTrace you can also view all of your funds fees in one location. Sort by the percentage you pay and the total dollars you pay per year to find the worst offenders.

The conventional wisdom remains, as always, to seek out cheap funds. This will generally mean index funds. Costs are probably your biggest enemy as an investor saving for retirement (though succumbing to temptation to time the markets and saving less than you should are close behind). Getting those costs down puts you one step closer to your ultimate goal.

Find out how much you need to save in order to retire comfortably. Sign up for a free trial of WealthTrace today. Learn more about how WealthTrace can help you.