Key Points:

- Prepare early for paying taxes in retirement. It can make a big difference.

- Many retirees are surprised that they have to pay income taxes on Social Security, but many people do.

- Delay taking withdrawals on IRAs and 401(k) accounts as long as possible.

- Roth IRAs are one of the best vehicles for avoiding taxes in retirement.

Retirement is Rarely Tax-Free

Try as we might, there is still almost no way to avoid taxes in retirement. Early retirement tax planning can certainly help, but be prepared to pay at least some taxes in retirement. The good news is that most people see their federal income tax rates decline substantially in retirement because their income goes down. The same applies to many state income tax rates as well.

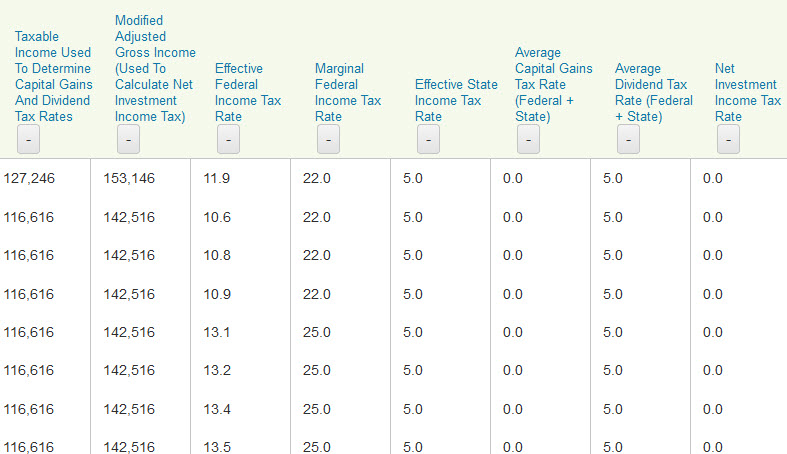

There are definitely ways to minimize taxes in retirement and it is a good idea to have all of your financial information and retirement goals set up in a retirement plan. The WealthTrace Financial & Retirement Planner allows you to gather all of your financial information in one location, run an accurate retirement plan, and figure out how to minimize your taxes in retirement. You can sign up for a free trial of the WealthTrace retirement planning software application and run what-if scenarios on taxes, tax minimization, and Roth conversion strategies.

View projected taxes paid and tax rates using the WealthTrace Planner.

Social Security Taxes

Tax planning for retirement includes when you take Social Security and what your income is at that time.

Are you taxed on the money that is taken out for Social Security from your paycheck? Yes you are. Can you then be taxed again when you receive Social Security benefits? Yes you can. This is known as double-taxation and Social Security is one of the worst offenders.

Social Security payments began being taxed at federal income tax rates in 1984. Originally taxes on Social Security payments were only supposed to hit the very rich. But the tax brackets were never indexed to inflation. Because of this, over time more and more people’s Social Security payments have been subject to federal income taxes. With inflation running so high now, it is only a matter of time before nearly everybody’s Social Security payments are subject to federal income taxes.

If you are working and receiving Social Security at the same time, it is almost definite that you will pay federal income taxes on your Social Security benefits due to your income level. This is one reason it might make sense to delay taking Social Security until you are done working. By delaying taking Social Security, not only can you reduce the taxes you pay, you also get an extra 8% payment per year that you delay.

Roth IRAs

Contributing to a Roth IRA can be a good move, but not always. The benefit of using a Roth IRA vs. a traditional IRA is that withdrawals in retirement on a Roth IRA are not taxable after age 59 ½ or after five years from when the contribution took place.

Many people also use Roth IRAs as a way for their heirs to inherit tax-free money. Their heirs will not have to pay taxes on withdrawals from the account if they inherit a Roth IRA.

Even though there are benefits to using a Roth IRA, too many people use them. A traditional IRA or 401(k) plan is still the best choice for most people. This is because most people have higher income tax rates before retirement than in retirement. Because of this, it is better to get the tax break for contributions to a retirement account while working and not yet retired.

The general rule of thumb is this: if your total marginal income tax rate is larger while working than you think it will be when retired, contribute to a traditional IRA or 401(k) account. If you project that your total marginal income tax rate will be larger once retired, then a Roth IRA makes more sense.

Roth Conversions

A Roth IRA conversion can save those approaching retirement thousands of dollars in taxes. This mainly applies to people who plan on retiring relatively early, before retirement income from Social Security, pensions, and Required Minimum Distributions begin.

Converting to a Roth IRA can save a person thousands of dollars if done at the optimal time. But you need to know when to convert the money. The best time to convert to a Roth IRA from a traditional IRA or 401(k) account is after you stop working, but before other retirement income kicks in. For example, if you plan on retiring at age 60 and will start receiving Social Security benefits at age 67, you will have 7 prime years where converting to a Roth IRA makes sense because your income tax rate during this time should be very low and you will pay income taxes on the amount converted.

Also make sure you spread out the Roth conversions over as many years as you can in order to drive down the taxes you pay even further. Because federal income taxes (and some state income taxes) are progressive, the income tax rate increases as income goes up.

Net Investment Income Tax

You might want to delay taking capital gains until you are done working in order to minimize capital gains taxes. Many investors don’t realize how easy it is to trigger the Net Investment Income Tax (NIIT) on capital gains and dividends. If you are single and your Modified Adjusted Gross Income (MAGI) is above $200,000 you will be subject to an additional 3.8% tax on capital gains and dividends. If you are married, the threshold is $250,000.

It is wise to plan out sales of investments that will generate capital gains so you can avoid the NIIT if possible. For this you would not only need a financial plan, but likely an accountant as well to make sure you understand the tax implications.

The Bottom Line

Plan early to minimize taxes in retirement. If you plan on retiring earlier than most people, this is even more important. Make sure you have a retirement plan in place that shows accurate projections that can help you figure out how to minimize your taxes in retirement. There are several ways to help avoid paying taxes you don’t have to such as delaying Social Security, converting to a Roth IRA, or delaying the sale of investments until your tax rate is lower. Use retirement planning software and have all of your information set up in a retirement plan. Otherwise you will not be able to figure out when strategies make sense.

Do you know want to build your own financial plan and minimize taxes in retirement? Sign up for a free trial of WealthTrace to be empowered and in control of your finances.