Key Points

- It might soon be a lot easier to purchase an annuity via your retirement plan (such as a 401(k)).

- Just because it's easier doesn't mean you should jump right in and do it, however. There are a lot of factors to consider.

- Whether an annuity is of interest to you or not, you'll probably still be dependent on the usual sources (investments in the stock and bond markets) for the lion's share of your retirement income.

There's legislation wending its way through congress that could have a big effect on savers and retirees. You can read about it here, but one of the changes proposed is to make it easier for annuities to be part of an employer's retirement plan options (its 401(k) plan, usually).

A lot of the details are still to be finalized, and there's no guarantee that it will get passed in any form (though the House passed it on a largely bipartisan basis). For us, it's cause for taking a fresh look annuities, and what place they might have in a retirement plan--or if there's any place for them in a retirement plan at all.

The Pros And Cons

The "pro" case for annuities, both in this legislation and more generally, is that they take a lot of uncertainty out of the process. Annuity payments are steady and predictable for the most part.

Further, says the "pro" side, our defined contribution plan based system (401(k)s and IRAs, mainly) doesn't really work. Savings rates are low; investors, if they do save, don't know what to do and are often paying too much in fees for too little in return--without knowing any better. "Why did we turn ordinary Americans into money managers," the argument goes, "burdened with the task of figuring out which funds to invest in or, even crazier, which individual stocks to buy?" Indeed, 60% of non-retirees who have 401(k) or IRA accounts have "little or no comfort" in managing their investments (see page 11 from this PDF report by Federal Reserve). Annuities in 401(k)s alleviate that problem.

The "con" side against annuities actually makes some of the same criticisms. Fees on annuities can be very high and difficult to find or calculate. The funds annuities invest in are also generally high-fee funds that are actively managed. Also, annuity returns, though steadier, are far lower than stock market returns over time. And deciding which annuities to consider buying can be every bit as complicated as trying to sort through the mutual fund options in your 401(k).

With an annuity, your money will probably be tied up for a while--and you'll be hit with a fee (known as a surrender charge) if you try to get it back. That's simply part of the trade-off you have to make to get guaranteed income for a certain number of years.

An annuity purchase makes you dependent on the financial stability of its issuer--not just today, but potentially for many years down the road. This is a real risk, but there are some mitigating factors. First, although insurance companies do fail, it's very rare. Second, and probably more importantly, each state has a Life and Health Guaranty Association (though the name of the entity varies by state), which essentially provides insurance for your insurance. Most states will guarantee up to $250,000 of the present value of annuity benefits; some states will go as high as $500,000. It's similar to the Federal Deposit Insurance Corporation (FDIC) on bank accounts. If you're the cautious type (and you are, if you're considering annuities), you'll probably want to know what the guarantees are in your state before you take the leap. But know that you do have a backstop at the state level.

What's On The Table

We'll leave variable annuities out of the discussion and focus on income annuities. There are exceptions, but in short, the fees on variable annuities are too high, and the products are complicated. Just stay away. That goes for equity-indexed annuities too, by the way.

That leaves fixed immediate annuities and deferred income annuities (DIAs).

Fixed Immediate Annuity

What it is: Fixed, immediate, periodic payments that will pay out for the rest of your life (and possibly your spouse's life too if you buy a joint and survivor annuity).

Good for: Those who crave simplicity and want the security of certain payouts, possibly for a specific anticipated need or goal.

Good because: The payments start right away, and will occur for the rest of your life, no matter how long you live.

Bad because: You're kind of asking a company to hold your money and give you an allowance.

Deferred income annuity (DIA)

What it is: A guarantee of fixed periodic payments that start sometime in the future.

Good for: Those who want a sort of insurance against outliving their money.

Good because: Your outlay should be relatively modest, because the insurance company will have some years to invest your money (and enjoy some gains) before paying you.

Bad because: You could have done the same thing yourself without the fees.

Further reading: EBRI, "Deferred Income Annuity Purchases: Optimal Levels for

Retirement Income Adequacy" (pdf)

Key finding: "We find that, at current annuity rates, purchases of a DIA at age 65 deferring 20 years with no death benefits result in an overall improvement in [preparedness for retirement] . . . for DIA purchases equal to 5, 10, 15, and 20 percent of the 401(k) balance. However, there is an overall decrease in [preparedness] for DIA purchases equal to 25 and 30 percent."

The Fee Question

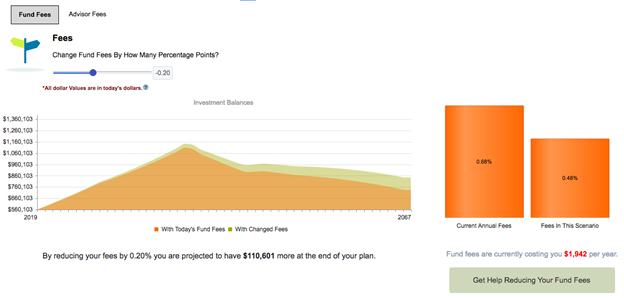

Fees--knowing what they are, what you're getting for them, and if lower alternatives are available--are as important as asset allocation and total returns in estimating the success of a retirement plan. That's especially true the further you are from retirement because of the effects of compounding, but it's true at any time. And not just for annuities, either. WealthTrace can run a what-if illustrating the effect of lower or higher overall fees over time on all investments:

Take It Or Leave It?

We don't really have a problem with making it easier to put annuities into retirement accounts. There are already plenty of high-fee, underperforming funds offered in 401(k) plans that somehow meet fiduciary requirements. Leaving annuities out doesn't make a lot of sense when viewed in this light!

We're only partially kidding about that last part. Generally, we think people can manage this stuff themselves: We have often recommended buying stocks directly (as opposed to via mutual funds) [links] to generate a portfolio of income-producing stocks. It can be done. Yes, there are risks that aren't present when purchasing an annuity. But there are potentially far greater rewards in exchange for those risks too.

Whether this new legislation gets through or not, the basics won't change. For a comfortable retirement, you'll need to save some money, and you'll need to take some risks with some of that money--probably most of it. An annuity could be part of a successful retirement plan, but what is done with the money *not* in the annuity over time is what's going to matter more.

What would buying an annuity do to your retirement plan? WealthTrace can help you find out. Click here to learn more.