Key Points

- A small difference in realized returns has a huge impact on retirement plans.

- Too many people are assuming rosy 8% stock returns for life.

- Being conservative with return assumptions is the safest route.

Ah, to have had a 401(k) plan from the early 80s through the late 90s. From 1980 through the end of 1999 the S&P 500 returned a whopping 1,186%. That is about 14% per year before inflation and 10.4% per year if inflation is stripped out.

At a real rate of return of 10.4% per year, a person starting with nothing in his 401(k) plan would have over $1.5 million in just 20 years if he maxes out his contribution of $18,000 per year and gets a $5,000 match from his employer. So a 25 year old would easily be a millionaire by age 45 in this example.

-balances-over-time.png?sfvrsn=0)

This example shows just how important stock returns are to a retirement plan. The power of compounding should not be underestimated when we are talking about long periods of time. On the flip side, one should also not underestimate what a long period of stock market stagnation can do to a portfolio either.

Stock Market Scenarios

Let’s take a look at an actual retirement plan and see just how changing rates of return impact when a person can retire comfortably. I put together a test case for a 30 year old couple. They each make $75,000 per year and both max out their 401(k) plan contributions at $18,500 each, while their employers match $5,000 each. They have $50,000 saved currently.

Because this couple is young, their asset allocation is 80% stocks, 20% bonds. For their return assumptions I used the average S&P 500 return over the past 40 years, which is about 8%. For bonds I used today’s yields on 10 year treasury bonds, which is about 3%. This gives their portfolio a weighted average expected annual returns of 7%.

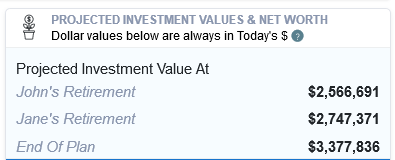

I ran their analysis in the WealthTrace Financial & Retirement Planner using these assumptions. I found the following:

I had set their retirement ages to age 64. So this is telling us that at age 64 they will have over $2.5 million in today’s dollar terms (inflation is stripped out). Also, at the end of their life expectancy of 85, they are projected to have over $3 million.

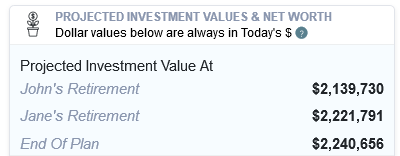

These results show the power of saving young, which leads to the power of compounding. However, remember that we assumed 8% returns every year for stocks. What if we reduced that to 7%, 6%, or even 5%? Using WealthTrace’s what-if capabilities, I quickly did this.

Reducing the return on stocks by 1% gives them about $500,000 less at retirement and more than $1 million less at the end of their plan. If we reduce the return assumption by 2%, they have nearly $1 million less at retirement. And if we reduce the returns by 3%, they have slightly less than $1 million at retirement.

Which Returns Should You Use?

I generally recommend not using an 8% return for stocks, even though that is what history has given us over the past 40 years. But it is dangerous to assume that this will hold up. Many of us make large life decisions based on retirement projections, and it is better to be safe than sorry. So knock at least 2% off that rate of return assumption and see how your portfolio holds up. If we do indeed get an average of 8% stock returns going forward, then great! You’ll have even more money to spend in retirement.

Find out how much you need to save in order to retire comfortably. Sign up for a free trial of WealthTrace today. Learn more about how WealthTrace can help you.