Key Points

- Social Security Is Projected To Be Short Of Funds In 2034

- Many people are worried, but some worry too much

- Make sure you are prepared for at least small cuts to Social Security benefits

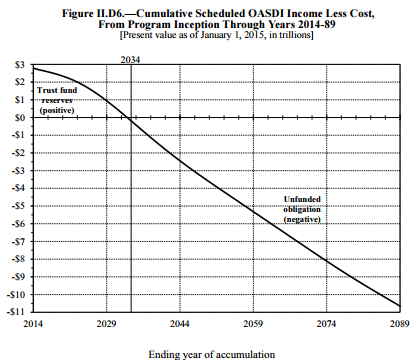

We’re getting closer and closer to D-day for social security. In 2014 the Social Security Administration (SSA) reported that the reserves from the Social Security trust fund will run out in the year 2034.

This is a bad situation that has not gone unnoticed by most people. An interesting survey from Bankrate found that nearly 25% of people in this country do not expect to receive anything from Social Security.

This kind of uncertainty makes it very difficult to plan for retirement, even if you have the best planning software in the world.

Is It Really That Bad?

It’s a bit crazy to think that 25% of the population won’t receive anything from social security. There would be protests, riots, politicians being run out of office, or worse. This simply won’t happen. This country borrows for everything else, so why not borrow more to pay out at least some of the promised social security benefits.

Another reason we shouldn’t expect massive cuts to social security is that the older generation votes in elections at a higher rate than younger people do. This means no politician wants to be associated with cutting their benefits for fear of being thrown out of office.

What Can Be Done To Save Social Security?

There is a misconception among many people that nothing can be done to save Social Security. They look at it like a giant meteor that’s about to hit the Earth: Just sit back and wait for the inevitable. But this is not the case.

There are several ways to “fix” Social Security, and some would be way less popular than others. The potential fixes are:

- Increase the payroll tax for Social Security

- Cut benefits for some people receiving Social Security

- Raise the cap on earnings subject to the Social Security tax

- Decrease the Cost Of Living Index (COLA) for benefits

I personally believe that option #1 won’t happen. I believe option #3 above is the most likely, with options #2 and #4 a serious possibility too. Currently wages up to $118,500 are hit with the Social Security payroll tax. This could be raised by an act of Congress to whatever they want. This appeals to politicians because it would only hit those in higher income tax brackets and would limit the fallout in terms of votes.

I also believe that those with lots of assets might see their benefits cut in retirement. The federal government could easily require us to submit our brokerage and bank statements to see who has more than, say $1 million. Those who do could then see their benefits reduced because “they don’t need it as much”.

I also believe the decreasing the change in benefits tied to the COLA index is a very likely possibility. For politicians this has the added benefit of being a stealth cut in benefits. Most people won’t even understand what happened and how their benefits decreased, similar to how inflation is a stealth tax.

How To Prepare

The best way to prepare for a potential decrease in social security is to make sure you have enough income from other sources. Using solid dividend growth stocks is my favorite way to provide income in retirement. Dividend champions such as Exxon, Wal-Mart, Johnson & Johnson, and Altria have never cut their dividends, ever. They can be the backbone of your retirement portfolio and can provide income forever. Also of note, dividend growth has been rising for many of these companies as the economy begins to heat up again.

For my own retirement plan I also reduce projected social security benefits by 20% to make sure that I am still covered by other income. This way I know that I can retire by 55, which is my goal.

Lastly, as I mentioned earlier, those with more assets are also more likely to see a reduction in their Social Security benefits. So if you’re retiring with over $1 million, you should run retirement scenarios where you see your Social Security benefits cut by at least 25% just to be safe.