Key Points

- Volatility appears to be back for the moment.

- Regarding your investments, staying the course is probably the best idea.

- But that doesn’t mean it’s time to go back to being complacent.

Volatility in the stock market is back.

Or maybe it’s just back this week. Who knows?

After a lot of months of complacency by investors, we had the biggest daily market drop in six years on Monday, and a fair amount of zigging and zagging the remainder of the week. At the time of this writing, it looks like we’ll have had a market correction this week.

Many of the articles we’ve seen in the past few days talk about staying the course and not making any changes to an investment strategy simply based on some market movements.

And there’s some wisdom in that. If you take a deep breath and look at the reality of the situation, a 10% drop is likely not make-or-break for you. If you’re a dividend-oriented investor, nothing much has changed. Your investments’ stocks have declined in value, yes, but those dividends should still keep rolling in. If you’re still decades away from retirement, a decline is good news for you. If you’re a buyer of stocks--and you likely are in that case, at the very least via your 401(k) or IRA--you want to see them cheaper, not more expensive. It’s no different from a trip to the grocery in that sense.

Few people are big fans of the volatility we’re seeing. 24-point headlines and breathless TV reports from stock market trading floors don’t lend themselves to calm, rational thinking. But a correction can be seen as a time for some reflection on whether you’re doing what you need to do to prepare for retirement.

You Know, Maybe It *Is* Time To Panic

Times like these can serve as a reminder that stress testing is important.

Since so much about the future is unknown, getting a retirement plan right is arguably a matter of probabilities. Through a Monte Carlo simulation, we can make a reasonable guess about how a portfolio will perform over time, and the chance of a plan succeeding.

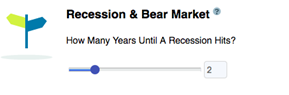

A market correction is one of those periodic curveballs that a Monte Carlo simulation takes into account. But it can also be useful to see what a market correction could do to your portfolio if it hit in a certain time period.

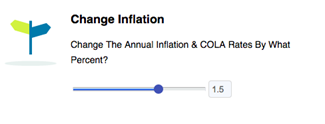

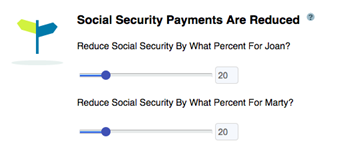

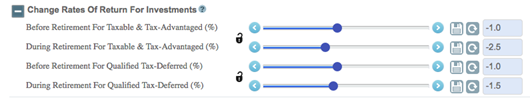

Other such curveballs include:

Inflation. Could we finally be in for some? It certainly seems more likely than it did a week or two ago. You might want to see how a percentage point or two increase could affect your plan.

Social Security. What if Social Security benefits are less than you are planning on? For some people, this could be a very big deal; for others, not so much.

Total returns. Past performance is no guarantee of future results. What would the effect be of trimming back your investments’ return expectations?

What’s the saying? Hope for the best and plan for the worst? It’s good advice, and at the very least is worth thinking about periodically. Market turbulence is a great reminder to do so.