Using A Retirement Estimator: Do You Know When You Can Retire?

Key Points

- Getting the numbers dialed in for retirement, especially if you're planning to retire early, is critical to making it work for you.

- Free online retirement estimators and calculators should be thought of as a starting point, not an ending point, when planning for retirement--especially an early retirement.

- WealthTrace allows you to throw any number of what-if scenarios at a retirement plan--a critical exercise for an early retiree. Sign up for a 14 day free trial here.

First, let's start with the no-calculator version. Figure out what you'll spend in retirement annually; make sure you have 25 times that saved; and voila.

But if it were really that easy, you would not be reading this article. Do you want to leave behind anything for heirs? What about major goals or expenses you have planned for certain years in retirement? What do taxes look like? These items don't easily fit on the back of an envelope.

Taking it one step beyond the envelope, you could use our free Retirement Withdrawal Calculator or our Early Retirement Calculator. That's better, but it has its limitations.

Go ahead and start with the Rule of 25, or the 4% Rule, or any number of different retirement shortcut rules you can read about online. And then do some calculations via online retirement estimators. But just be sure not to end your research there. Getting the numbers dialed in for retirement, especially if you're planning to retire early, is critical to making it work for you.

The Best Laid Plans

A weather forecast is most accurate the closer you are to the day or time being forecast. You can look at a 15-day forecast and be pretty sure that the 15th day out won't be exactly right. Depending on where you live and the season, the temperature range forecast will probably be close, but whether there will be precipitation or clouds is, let's be honest, a best guess.

Similarly, a plan for an early retirement is going to have some unknowns in it. Although we can make reasonable assumptions about what an average rate of return on an investment portfolio will look like over time, no one can say with any certainty what the stock market will do in any given year 10 or 20 or 30 years from now.

So it's important to get the knowns right, or as close to right as possible. Free online calculators often do not allow you to enter enough of the knowns. Just as important, the calculators often don't allow you to make modifications to certain figures (such as the rate of inflation) that can vary.

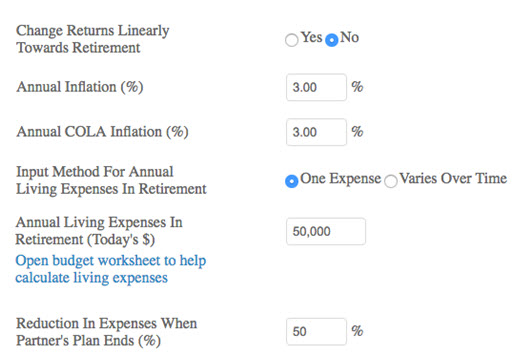

But WealthTrace does. Here are just a few of the settings you can change:

Shocks To The System

With early retirement, one important thing you will probably be giving up is compound interest: You will simply have fewer years of compounding returns on your investments to build wealth before you retire. To make up for that, you will probably also be giving up the use of some income in the near term, because you need to save more of it so you can retire early.

This compressed timeline means (among other things) that low-probability but entirely possible negative events could have an outsized effect on your investments, and thus your retirement. Market corrections or downturns or whatever you want to call them happen all the time, and the typical investor can weather them pretty easily. In fact, a market dip can be to a younger investor's advantage, as it allows for money to be invested at lower prices.

But a downturn can be disastrous for an early retiree. If you want to be as certain as possible that early retirement will work for you, you need to be able to stress test your assumptions. You won't find that ability in a free online calculator.

WealthTrace can help with the stress testing. Here are a few things you can do with WealthTrace:

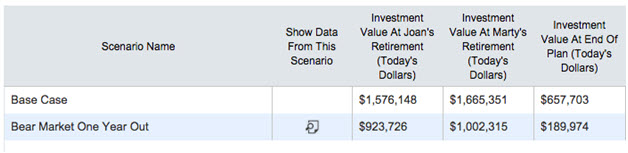

What if you're hit with a bear market near the beginning of your retirement? Or five years into your retirement? We can run the numbers for you:

A bear market (such as what we experienced in 2007-2009) hitting just as retirement starts can be a doomsday scenario. Anyone considering retirement should have a decent idea of what a market downturn early could mean. WealthTrace can handle that for you.

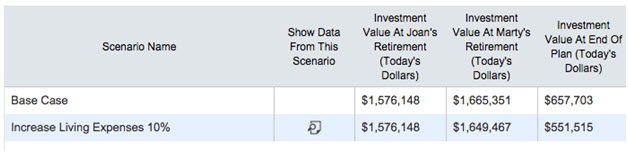

Or what if your living expenses end up being a lot higher than you had expected?

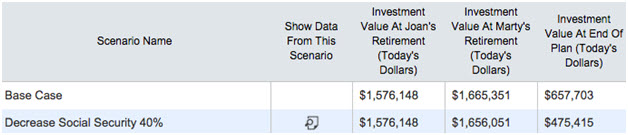

In the following scenario, Social Security payments (which WealthTrace accounts for) are reduced by 40%. Uncertainty about Social Security benefits is a very real concern for many retirees, and especially early ones. WealthTrace can do the math on it.

WealthTrace can help with plenty of other scenarios too, having to do with contributions to retirement accounts, pension payments, election to take Social Security, and more.

If you're fortunate enough to be even considering early retirement, congratulations. Just be sure you have covered all the bases first.

For a detailed, accurate look at your retirement situation, sign up for a free trial of WealthTrace.